Strategic Leadership & Governance IG

By J Katherine Bahr CEOs have long been criticized for their tendency toward the dark triad of personality traits: narcissism, psychopathy and Machiavellianism. Ample research shows that dark triad traits endanger…

Read MoreHigh inter-unit competition worsens the situation as narcissistic executives are concerned with their sense of superiority and uniqueness; however, high environmental complexity or dynamism can combat such negative effects as…

Read MoreRead this post and learn: Three reasons for top management team (TMT) structure development: instrumental, institutional, and instructionalist The interplay of formal and informal structures: competing vs. complementary dynamics It…

Read MoreRelease date: December 6, 2021 Speakers: Anita McGahan (University of Toronto), Phanish Puranam (INSEAD), Samina Karim (Northeastern University), and Aseem Kaul (University of Minnesota) Description: Following extensive discussions of job market issues, the SMS…

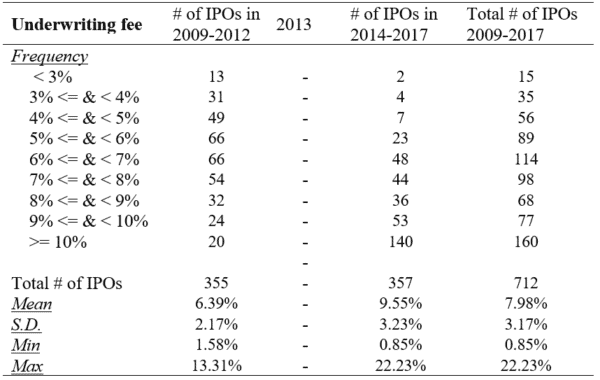

Read MoreBy Yan “Anthea” Zhang (Rice University), Jin Chen (University of Nottingham Ningbo China), Haiyang Li (Rice University), Jing Jin (University of International Business and Economics, China) In a mature stock…

Read MoreDonald C. Hambrick, recipient of the 2021 CK Prahalad Award for Scholarly Impact on Practice, was interviewed by Andreas König, University of Passau, in this webinar.

Read MoreBy Yan “Anthea” Zhang, Zhuo Chen and Yuandi Wang Patents are important assets to many firms. Firms can not only use patents to protect their new inventions, but also can secure…

Read MoreRelease date: August 25, 2021 Speakers: Marie Louise Mors (Copenhagen Business School), Chris Rider (University of Michigan), Samina Karim (Northeastern University), and Aseem Kaul (University of Minnesota) Description: As we head…

Read More