by Gábor Békés, Gabriel R.G. Benito, Davide Castellani and Balázs Muraközy

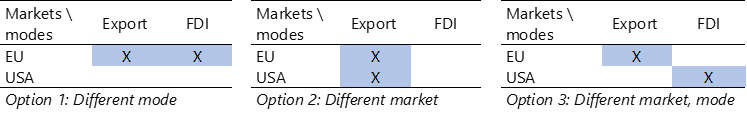

A medium-sized chemical manufacturer from Bologna in Italy is already exporting its products across the European Union (EU) and is considering extending its international activities. Its management is discussing three options: Setting up another plant in France, starting to export to the USA or, even, opening a new factory there, in Atlanta. While these options clearly require very different capabilities and carry quite different levels of risk, traditional measures of internationalization often cannot distinguish well between them. For example, counting the number of markets the firm serves would find the two latter options similar, while focusing on whether the firm conducts an internationalization mode requiring a large level of commitment (foreign direct investment, FDI) will find options 1 and 3 very similar.

A more nuanced way to look at firms’ internationalization is to consider their international footprint; that is, the combination of the markets in which a firm operates and the modes it engages in. In this simple matrix, which is not very demanding in terms of data, the choices above can be represented easily and clearly.

FIGURE 1: International footprints.

This representation shows in a straightforward way that choosing option 3 is certainly a bolder decision because the firm both starts a new mode and enters a new market at the same time. Visually, the firm increases the scope of its footprint along both dimensions rather than only one, even though the number of market-mode combinations is the same in all three options.

In our paper we use this intuition to develop new measures to characterize key strategic aspects of the footprint in a simple way. The first key measure is the extent of the footprint, capturing the number of market-mode combinations the firm conducts. The second key measure is boldness, which compares the size of the matrix spanned by the firm’s activities with the extent of internationalization. Comparing firms that have the same extent, the larger the matrix is, the bolder the firm. To show that it is in line with our intuition, let us compare options 1 and 3. While the extent of both these footprints is two, option 1 only spans a 1×2 matrix (the combinations can be covered by a 1×2 matrix), while option 3 spans a 2×2 matrix. Therefore, option 3 is the bolder choice. We generalize this idea to be able to compare firms with different extents and also allow for different weights for different markets and modes to capture the differences in terms of risk or resources needed.

To investigate the relevance of this concept for strategic management research and practice, we adopt a microfoundations lens to develop hypotheses about how managerial characteristics affect the extent and boldness of the international footprint of a firm.

We use the unique EFIGE database of 14,000 firms from seven European countries, which combines direct information on the international footprint of the firms with many of the key microfoundations variables, to test these hypotheses. These data allow us to distinguish between 8 global markets — roughly representing continents — and in terms of modes we can distinguish between exporting, importing, contracts, and FDI.

Because the new measures of firms’ international footprint we develop in this paper connect directly to central strategy concepts of capability and risk, they are potentially particularly useful for analyzing the relationship between internationalization and performance.

Our results suggest that (i) larger management teams and (ii) older CEOs tend to be associated with a greater extent of international operations, but not with greater boldness, in line with the idea that these managerial characteristics are associated with greater managerial capabilities, but not necessarily higher risk-taking propensity. Instead, firms whose top management team has more international experience exhibit greater extent and boldness of the international footprint, suggesting both higher capability to manage complex operations and higher risk-taking propensity. Finally, firms managed by a CEO who is part of the family that controls the firm tend to choose an international footprint with more limited extent and boldness, consistent with the view that these firms may have both lower managerial capacity and higher risk-aversion.

Because the new measures of firms’ international footprint we develop in this paper connect directly to central strategy concepts of capability and risk, they are potentially particularly useful for analyzing the relationship between internationalization and performance, which is at the core of what strategy research may offer to managers and business decision-makers. Furthermore, the logic developed and demonstrated can be applied to other strategic dimensions of firms’ activities, where the amount or extent of activities depends both on risk-taking and on capabilities. Examples are product differentiation, diversification, or portfolios of R&D projects.

About the authors

Gábor Békés is assistant professor at Department of Economics and Business, Central European University, research fellow at the Research Center for Economic and Regional Studies (CERS), Budapest, Hungary, and affiliated with Centre for Economic Policy Research (CEPR), London, UK. https://people.ceu.edu/gabor_bekes

Gabriel R.G. Benito is professor at Department of Strategy and Entrepreneurship, BI Norwegian Business School, Oslo, Norway. https://www.bi.edu/about-bi/employees/department-of-strategy-and-entrepeneurship2/gabriel-robertstad-garcia-benito/

Davide Castellani is professor at Henley Business School, University of Reading, Reading, UK. https://www.henley.ac.uk/people/davide-castellani

Balázs Muraközy is lecturer at Management School, University of Liverpool, Liverpool, UK, and research fellow at CERS, Budapest, Hungary. https://sites.google.com/view/balazsmurakozy

Read the full article here (open access): https://onlinelibrary.wiley.com/doi/full/10.1002/gsj.1397

Please cite as: Békés, G, Benito, GRG, Castellani, D, Muraközy, B. Into the unknown: The extent and boldness of firms’ international footprint. Global Strategy Journal. 2021; 1– 26. https://doi.org/10.1002/gsj.1397