by Kurt Desender and Mircea Epure

This year marks the 50th anniversary of Milton Friedman’s influential New York Times piece, which argued that corporations should pursue value maximization while other socially responsible actions can be managed efficiently via explicit political processes with proper checks and balances. Some scholars contend that this approach neglects the role of stakeholder relations for long term survival, and recent efforts update perspectives by bringing ownership back to the core of stakeholder management. Prominent investment companies signal societal goals. In 2018, Laurence Fink, Chairman and CEO of the investment firm BlackRock, informed business leaders that: “To prosper over time, every company must not only deliver financial performance, but also show how it makes a positive contribution to society.” In a similar spirit, the Business Roundtable released in 2019 a “Statement on the Purpose of a Corporation signed by 181 CEOs who “commit to lead their companies for the benefit of all stakeholders—customers, employees, suppliers, communities and shareholders.”

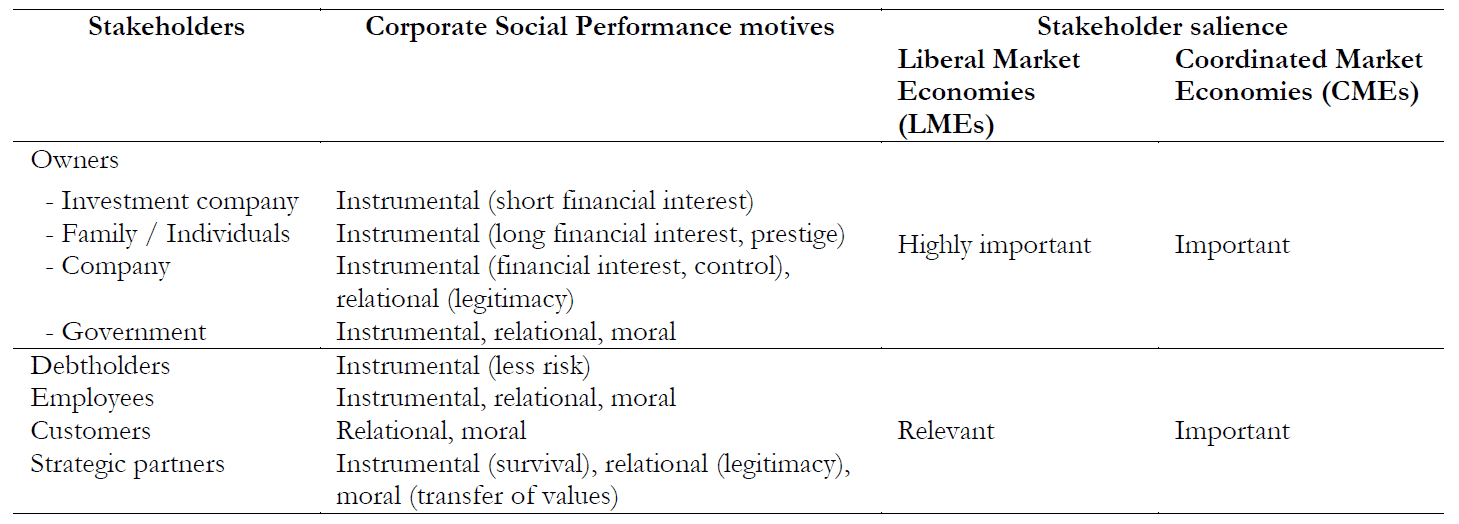

In a recent article—“The pressure behind corporate social performance: Ownership and institutional configurations”—we argue that corporate social performance (CSP) is the outcome of organizations being pressured to engage in socially responsible actions by owners of different types and other stakeholders, with diverse motives and salience in the institutional setting. Table 1 shows that actor level CSP motives are not homogenous. Depending on the type of owners motives can be instrumental (e.g. financial interest of investment companies or voter opinion on government owners), relational (e.g. stakeholder legitimacy for family firms) and moral (e.g. government owners promoting ethical standards). The larger the owners’ stake and thus their proportional claim on firm results, the higher will be their power to affect CSP. Further, institutional configurations shape owner salience relative to other stakeholders, and therefore their ability to impact organizational strategy and results.

Table 1. Corporate Social Performance Motives and Stakeholder Salience

Comparative corporate governance has shown that institutions matter and that groups of countries tend to display similar features regarding how stakeholders coordinate actions. Drawing on the Varieties of Capitalism framework, we design a “laboratory” for exploring the influence of ownership types on CSP. Countries generally cluster into Liberal Market Economies (LMEs, such as the US, UK and Ireland) and Coordinated Market Economies (CMEs, such as France, Germany and Spain). LMEs feature more market-oriented financial systems, dynamic labor markets, and a focus on impersonal market transactions rather than closed networks of firms. Conversely, CMEs rely more on bank or state financing, rigid labor regulations that protect employees, and personal transactions often occurring in established firm networks which give prominence to broader stakeholder groups.

We propose that owners are the key stakeholders in LMEs, and that most of them (except government owners, and especially investment companies) will largely support instrumental CSP initiatives that enhance (short term) firm value. This contrasts with the position of other stakeholders, who have stronger relational and moral motives, but generally have little salience. In contrast, in CMEs the salience of stakeholders such as debtholders, employees and customers is much stronger, and the interest of owners becomes one of many to consider.

Our results from an international panel reveal that the baseline relationship between the presence of powerful owners (i.e. those who hold at least 5% of shares) and CSP can be negative (for investment companies) or positive (for governments). Importantly, the magnitude of these results is substantially higher in LMEs, where shareholders are the main stakeholder. In contrast, in CMEs owners have a much weaker impact on CSP, which is not due to their scarcer presence, but instead due to the counterbalance of multiple stakeholders’ interests.

Taking a critical perspective on institutional design, policymakers who wish to pursue CSP through owner responsibility should consider the salience of shareholder and stakeholder interests. For instance, in LMEs the interests of market-oriented owners are relatively salient and policymakers increasingly introduce CSP guidelines such as the UK Stewardship Code, instructing owners to coordinate with stakeholders. This type of policy may hold less relevance in CMEs, in which the interests of market-oriented owners are less salient and more prominence is given to a large set of stakeholders. For example, the Spanish governance code for listed companies requires concrete social practices, such as opening channels for stakeholder communication. But in such a CME, the business environment already promotes the relational motives of a broad set of stakeholders, ensuring a high pressure on CSP.

Based on: Desender, Kurt, and Epure, Mircea, 2020. The pressure behind corporate social performance: Ownership and institutional configurations. Global Strategy Journal, forthcoming. https://doi.org/10.1002/gsj.1390

Authors bio:

Kurt Desender is Associate Professor in the Department of Business Administration at University Carlos III. He was a visiting scholar at the University of Illinois at Urbana-Champaign in 2009 and 2013. In 2010, he received his PhD degree in Economics, Management and Organization from the Universidad Autónoma de Barcelona. His research interests lay in the areas of corporate governance, corporate social responsibility, strategic management and financial accounting. His work has been published in some of the reference journals in Management, such as the Strategic Management Journal, Journal of International Business Studies and Academy of Management Annals.

Mircea Epure is Associate Professor at Universitat Pompeu Fabra, Department of Economics and Business, and Affiliated Professor at the Barcelona GSE. He has a PhD in from Universitat Autònoma de Barcelona (a joint European Doctoral Program with Växjö University, Sweden). He is interested in corporate governance, entrepreneurship, and firm performance. His work was published in leading journals including the Journal of Business Venturing, Global Strategy Journal, Journal of Comparative Economics, European Journal of Operational Research and Journal of Business Finance & Accounting. Epure’s research was cited in The Oxford Handbook of Corporate Law and Governance, and World Bank studies.