Civil war and violent social conflict drove headlines around the world in 2016 with conflict in Syria, the Mediterranean refugee crisis, and the backlash to immigration taking center stage across Europe and the US. But citizens are not the only actors who have to choose whether to flee or persist when armed conflict hits a country. “Caught in the Crossfire”, a forthcoming paper in SMJ by Li Dai, Lorraine Eden, and Paul Beamish, studies how multinational companies react to armed conflict.

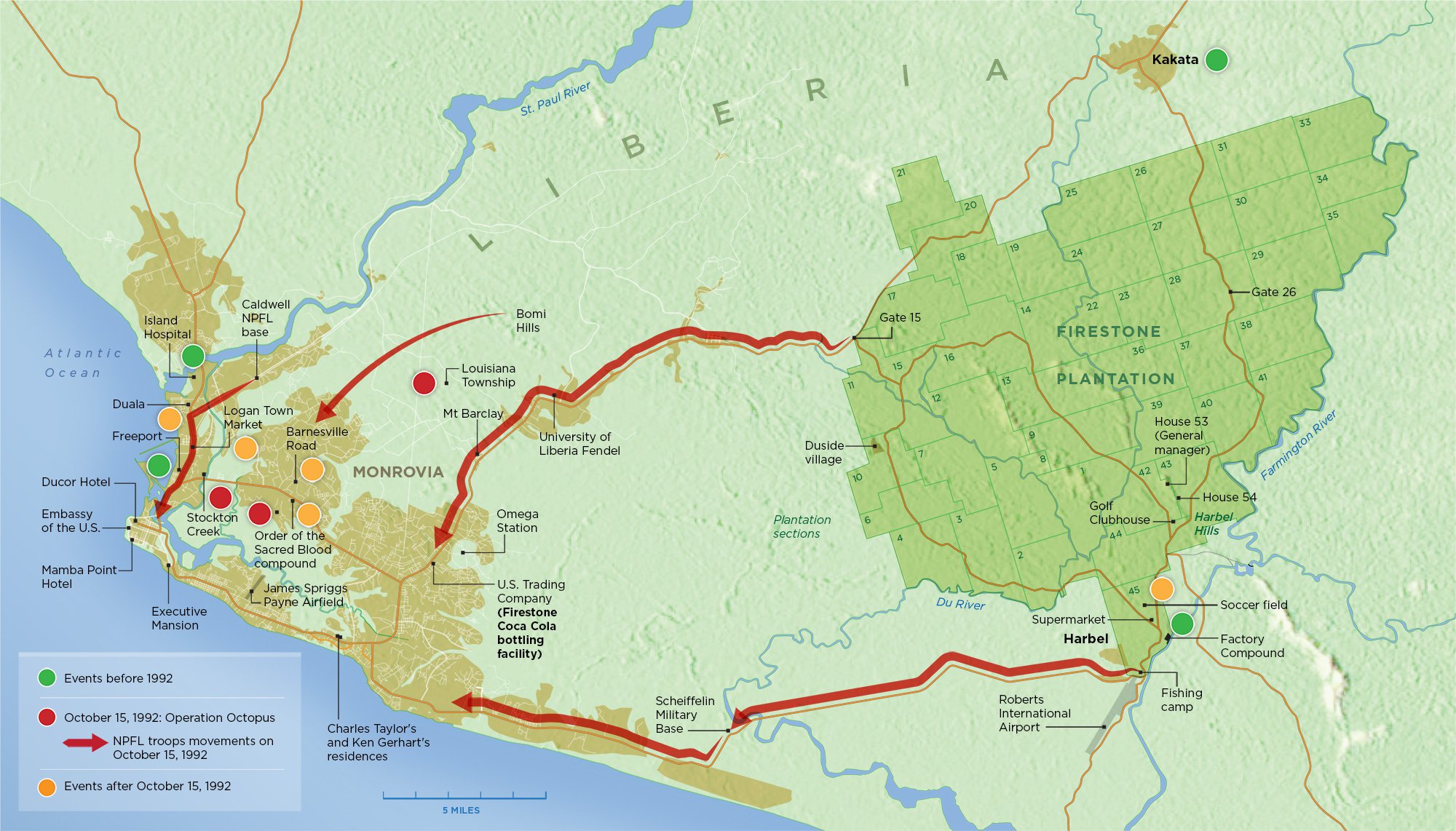

Firestone was drawn into a pivotal role in Liberia’s brutal civil war in the 1990s. Learn more from Pro Publica’s investigation.

While armed conflict has fallen dramatically since 1990, the scholars document that the number of ongoing conflicts has held steady or risen since 2013. Meanwhile, international corporate investments in emerging markets where risk of conflict is greater have risen enormously since 1990, from less than $1 billion to more than $23 billion in 2014.

The study predicted that the more vulnerable companies are to conflict, the more likely they are to leave. In an analysis of Japanese multinational subsidiaries in 20 war-afflicted countries, the analysis found that a measures of exposure to conflict does indeed increase the likelihood of exit – if a subsidiary falls within a zone of conflict the company is 65% more likely to exit the country. But if the resources in the country are large and important for the overall multinational, the firm is less likely to exit. The researchers also predicted that companies with more experience in war-afflicted countries, a measure they denote as resilience, would be less likely to leave, but, surprisingly, the data shows the opposite: multinationals more exposed to conflict across their subsidiaries are more likely to leave.

The authors conclude that some traditional sources of advantage for multinationals, in particular valuable resources developed by subsidiaries, can actually make them more vulnerable to extreme political risk such as war and armed conflict. In addition, the study suggests that duplication and balance of investments and resources across a multinational network can reduce the vulnerability of a company to political instability in any one location.