By Cristiano Bellavitis, Joost Rietveld, Igor Filatotchev

Have you ever wondered whether Leonardo DiCaprio and Martin Scorsese should work on yet another movie together? Or why Greylock Partners and Sequoia Capital regularly invest together? A paper that has recently been published in the Strategic Entrepreneurship Journal answers these questions. Researchers from Auckland Business School, UCL School of Management, and King’s Business School investigate the effects of repeated co-investments between venture capitalists (VCs) in the United States (U.S.) on a venture’s likelihood of making a successful exit.

At last count, DiCaprio and Scorsese have worked on six movies together. They are not alone in this behaviour of repeatedly collaborating with the same partners. Individuals and firms repeatedly collaborate with each other. Be it actors and movie directors, or venture capital investors; we like working with the same people over and over. The sense of familiarity involved in repeatedly working with the same partners offers strong advantages. After a few collaborations, we begin to trust each other and develop working routines. We feel more relaxed and at ease. Familiar partners make the collaboration feel more natural and trustworthy, reducing the risks involved in a collaboration: the potential for partners’ misbehaviour and opportunism. These characteristics embedded in collaborations with familiar partners lead to faster progress and a potentially more efficient collaboration and, as a result, better performance.

However, there also is a “dark side” to repeated collaborations. Repeatedly working with the same partners increases certain risks. Repeatedly partnering with the same people creates overlapping networks and expertise. Familiar people also tend to have similar thinking patterns induced by common prior experiences. This might lead to groupthink and even over-investments in trust between partners, meaning that they don’t question or hold each other accountable anymore. As a consequence, the creativity and innovativeness of the collaboration might be jeopardized by additional collaborations, eventually leading to negative performance outcomes. Hence, there are both advantages and disadvantages in working with familiar partners. Familiarity improves a partnership’s performance, but only up to a certain point, after which the performance of the partnership starts to decline.

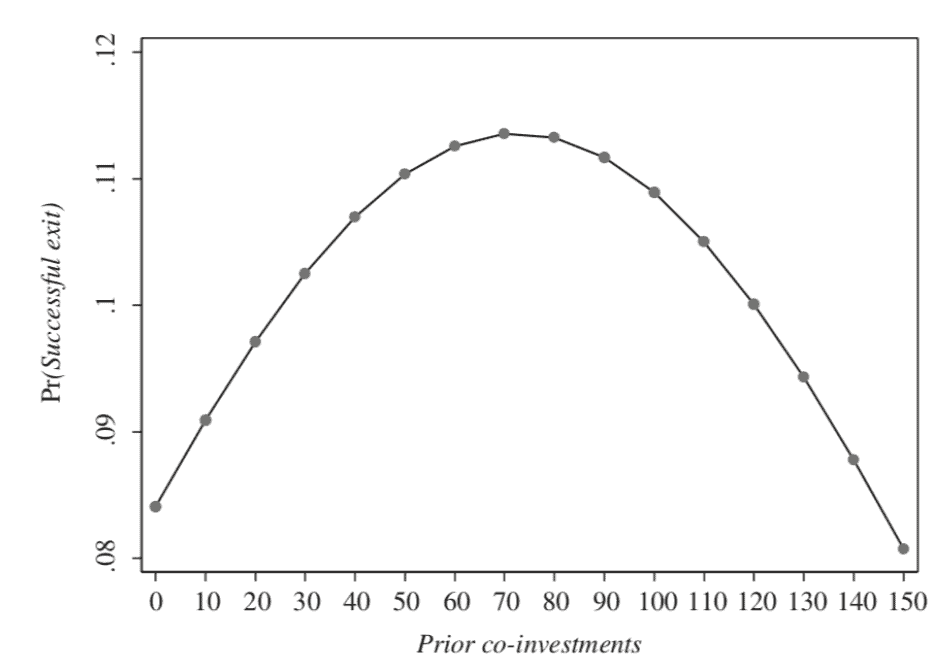

In the SEJ paper, the researchers conduct a longitudinal study of 4,550 U.S. ventures receiving syndicated investments from 1980 to 2017. Results show that there exists an inverted U-shaped relationship between the number of prior co-investments and a venture’s likelihood of a successful exit through IPO or M&A. Figure 1 shows that the predicted probability of a successful exit increases from 8.4% at 0 prior co-investments to 11.3% at 70 co-investments, after which it declines to 8.0% at 150 prior co-investments. Hence, when the number of prior co-investments increases from a low to a moderate level, chances of a successful exit increase by 34%. However, when prior co-investments continue to increase from a moderate to a high level, the likelihood of a successful exit falls by 30%.

Figure 1. Marginal effects for H1 (main effect of prior co- investments)

Further, the researchers find that the advantages and disadvantages of repeated collaborations depend on the type of collaboration. They find that the level of risk embedded in the project, e.g. the age of the venture that VCs are investing in, emphasizes both the advantages and disadvantages of working with familiar partners. They also find that working with familiar partners that are geographically closer reduces the advantages of familiarity. In other words, VC investors should be more “adventurous”, selecting unfamiliar partners if they are located nearby.

The study offers some important implications. Individuals and investors should consider both the advantages and disadvantages of collaborating with the same partners over and over. Familiarity can lead to better performance, but “over-familiarity” can negate these benefits. This suggests that our innate desire to fall back on the same partners must be controlled in the interests of a project’s performance. In other words, Martin Scorsese may consider working with a different actor for his next movie if he wants to maintain stellar box office revenues.

Bio

Cristiano Bellavitis is a Senior Lecturer (Advanced Assistant Professor) of Innovation and Entrepreneurship at the Faculty of Management and International Business of Auckland Business School. He is moving to Syracuse University in August 2020. Cristiano obtained his doctorate in management from Cass Business School, London. He is the incoming co-editor for Venture Capital: An International Journal of Entrepreneurial Finance. His work has been published in leading international journals such as Organization Science, Strategic Entrepreneurship Journal, British Journal of Management, Journal of Small Business Management, among others. He is also portfolio manager at Integer Investments, an asset management company investing in stocks and real estate.

Joost Rietveld is Assistant Professor in the department of Strategy & Entrepreneurship at the UCL School of Management. His research interests are at the intersection of technology strategy and innovation management. Joost’s research seeks to understand how inter-organizational dynamics, including platform-complementor relationships, alliances, and mergers and acquisitions, affect product-level outcomes. He is also interested in how digitization facilitates new and innovative ways of doing business including the freemium and platform business models. Joost’s research has been published in highly ranked academic journals including Organization Science, Research Policy and the Strategic Entrepreneurship Journal. His PhD thesis was awarded finalist in best dissertation competitions organized by INFORMS (TIMES section) and the Academy of Management (TIM division). Joost has taught courses at various institutions including New York University, the New York Film Academy and the Rotterdam School of Management at Erasmus University.

Igor Filatotchev is Professor of Corporate Governance and Strategy at King’s Business School, King’s College London, and a Visiting Professor at Vienna University of Economics and Business. He received his PhD in Economics from the Institute of World Economy and International Relations, Moscow, the Russian Federation. His research interests are focused on corporate governance effects on entrepreneurship and strategic decisions; sociology of capital markets. He has published more than 150 academic papers in the fields of corporate governance and strategy including publications in leading academic journals such as Academy of Management Journal, Strategic Management Journal, Journal of International Business Studies, Organization Science, and Journal of Management. He served as an Editor in Journal of Management Studies, Corporate Governance International Review and Journal of Management and Governance.